Loans Online

Monthly instalment loans online are a good alternative to payday loans. They take slightly longer to set up, but you will find that the interest rates are cheaper.

A loan online can be a great way to get money if you need it quickly. However, before you apply, it is important to make sure you understand the risks associated with borrowing. You will also need to check whether the lender you are applying to is legitimate.

When you choose a lender, you will need to provide your contact details. If you have provided the correct information, you can expect to have your money in your bank account within one hour.

There are many types of loans available on the market. These include personal loans, payday loans, and loans that you can use to pay off credit cards. Each has its own set of benefits, but each can be very useful.

Some loan companies offer up to two repayment holidays per year. The amount you can borrow is also dependent on your circumstances. Your loan can be paid out over one, three, or five years. It is recommended that you only borrow as much as you can afford to repay. This will help protect your financial future.

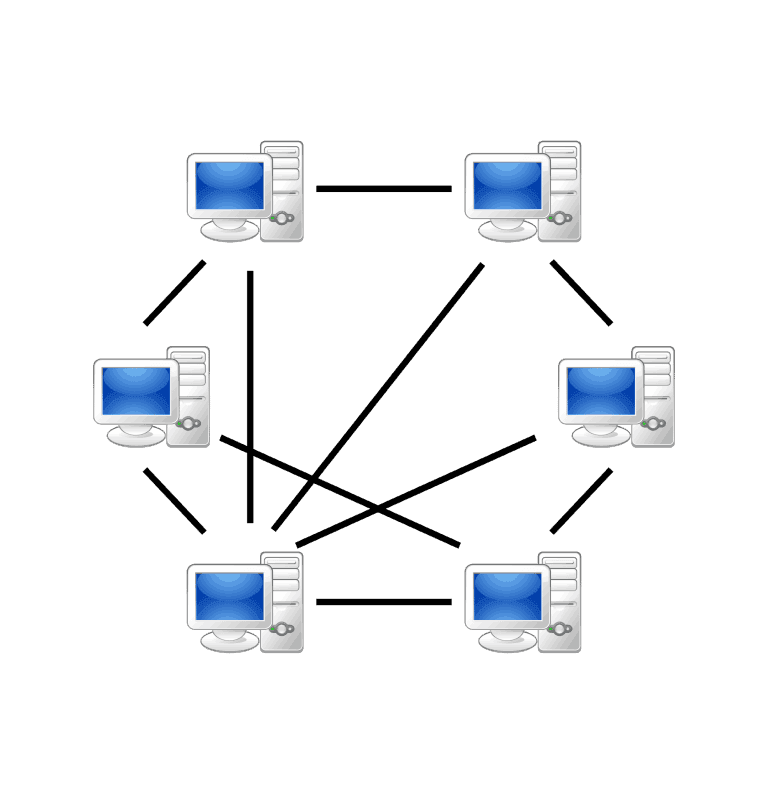

Many lenders offer loans online. Although it can be tempting to apply for as many loans as possible, this can affect your credit rating. In addition, you may also find yourself paying high interest rates.